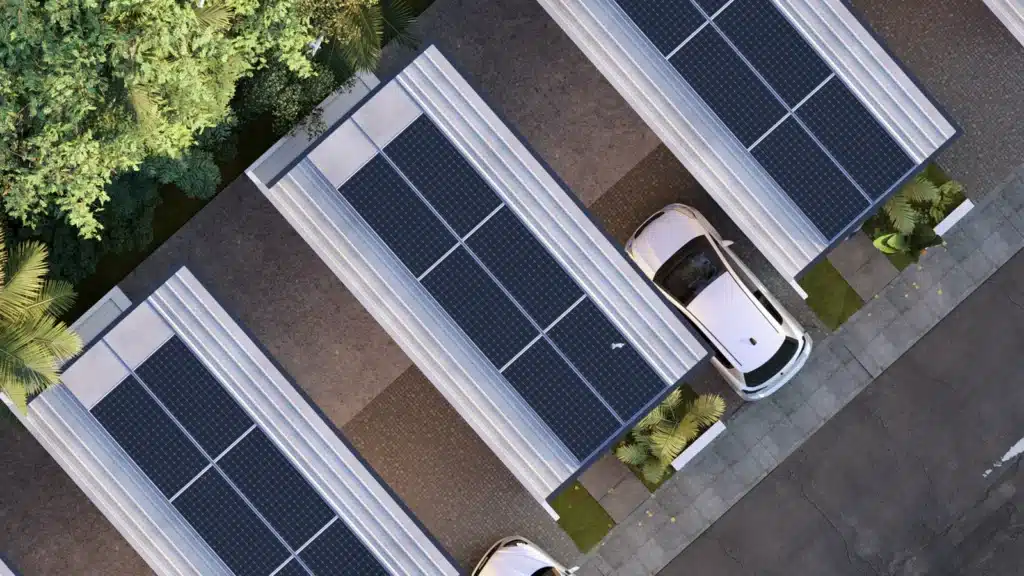

Switching to solar energy in the Philippines isn’t just a smart move for your wallet; it’s also supported by the government through various incentives.

1. Net Metering Program

Introduced under the Renewable Energy Act of 2008, the Net Metering Program allows homeowners and businesses to install solar power systems up to 100 kilowatts (kW).

Excess electricity generated can be exported back to the grid, earning credits that offset future electricity bills. This system promotes the use of renewable energy and offers financial savings over time.

2. Income Tax Holiday (ITH)

Under the Renewable Energy Act, renewable energy developers, including those in solar energy, are entitled to an Income Tax Holiday for the first seven years of their commercial operations. This incentive reduces the financial burden during the initial phase of operation, encouraging investment in solar energy projects.

3. Duty-Free Importation of Renewable Energy Equipment

The government offers duty-free importation of renewable energy equipment and materials for the first ten years of operation. This policy lowers the upfront costs for solar energy projects, making solar power more accessible to developers and consumers alike.

4. Value-Added Tax (VAT) Zero-Rating

Solar energy developers can avail of VAT zero-rating on the sale of fuel or power generated from renewable sources. This incentive reduces the cost of electricity generated from solar power, benefiting both producers and consumers.

5. Green Energy Option Program (GEOP)

The GEOP allows consumers to choose renewable energy sources for their electricity supply. Under this program, consumers can select their preferred renewable energy supplier, promoting the use of clean energy and supporting the growth of the renewable energy sector.

6. Feed-in Tariff (FiT)

The FiT program guarantees fixed payments for electricity generated from renewable sources, including solar power. This long-term contract provides financial stability for solar energy producers and encourages investment in renewable energy projects.

7. Carbon Credit Incentives

Businesses that implement solar energy solutions can earn carbon credits by reducing their carbon emissions. These credits can be traded or sold, providing an additional revenue stream and promoting environmental sustainability.

8. Financing Options

Several financial institutions in the Philippines offer loans and financing packages for solar energy installations. These options make it easier for homeowners and businesses to invest in solar power without the need for large upfront payments.

The Philippine government’s incentives for solar energy adoption make transitioning to solar power more accessible and financially viable.

By taking advantage of these programs, you can reduce your energy costs, contribute to environmental sustainability, and support the growth of the renewable energy sector in the country.

If you’re considering solar energy for your home or business, explore these incentives and consult with certified solar energy providers to make the most of the available opportunities.

References

- Department of Energy Philippines. Net Metering for Homeowners. Retrieved from https://doe.gov.ph/net-metering-home

- Department of Energy Philippines. Renewable Energy Developers. Retrieved from https://legacy.doe.gov.ph/re-developers

- PwC Philippines. (2024). Is Investing in Renewable Energy a Power Move? Retrieved from https://www.pwc.com/ph/en/tax/tax-publications/taxwise-or-otherwise/2024/is-investing-in-renewable-energy-a-power-move.html

- Nativ Techniks. Solar Energy Policies in the Philippines. Retrieved from https://nativtechniks.com/solar-energy-policies-in-the-philippines/

- KPMG Philippines. (2022). The Future is Renewable. Retrieved from https://kpmg.com/ph/en/home/insights/2022/11/the-future-is-renewable.html

- Solaric. Solar Power Incentives for Filipino Factories. Retrieved from https://solaric.com.ph/blog/solar-power-incentives-for-filipino-factories/

- ASG Law Partners. (2024). VAT Zero-Rating for Renewable Energy: Key Requirements and Implications. Retrieved from https://www.asglawpartners.com/tax-law/2024/08/07/vat-zero-rating-for-renewable-energy-key-requirements-and-implications/

- Philergy. Highest Quality German Solar System with Net Metering Service in the Philippines. Retrieved from https://www.philergy.com/post/highest-quality-german-solar-system-with-net-metering-service-in-the-philippines-philergy