Learn how to finance your green home renovation with grants, loans, and incentives. Discover cost-effective ways to make your home environmentally friendly.

PHOTO: Freepik

As interest in sustainable living continues to surge in the Philippines, more homeowners are exploring the concept of sustainable housing. This involves making environmentally conscious decisions when renovating homes, emphasizing energy efficiency, and minimizing environmental impact.

However, one common hurdle is the financial aspect of these green renovations. This article sheds light on the various financial support mechanisms for those keen on embracing this green lifestyle. Read on to learn more.

Government Grants and Subsidies for Eco-friendly Upgrades

Homeowners in the Philippines are finding significant support from government grants and subsidies in housing. One is the PAG-IBIG Housing Fund, a government-mandated program providing affordable housing loans for Filipinos. But did you know that PAG-IBIG also extends financial assistance for eco-friendly upgrades?

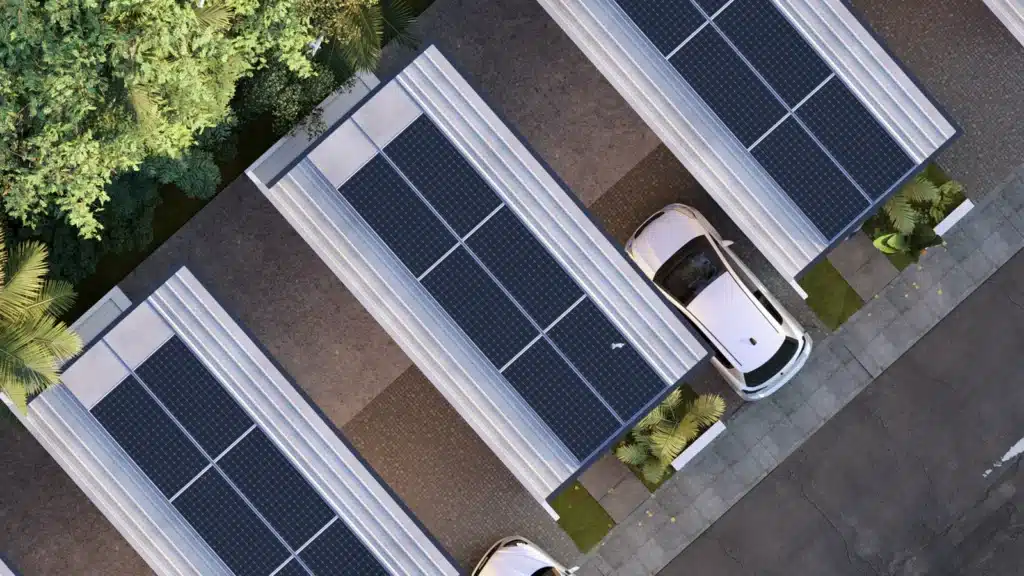

PAG-IBIG’s commitment to sustainable housing goes beyond the acquisition of new homes. It also includes provisions for installing energy-efficient fixtures such as solar panels. This is part of an ongoing initiative to promote energy conservation in residential spaces. A qualified PAG-IBIG Fund member interested in making their home more energy-efficient may avail of a housing loan specifically for the acquisition or installation of solar panels.

The application process for these green subsidies is similar to regular PAG-IBIG housing loans. After ensuring you meet the qualifications, you can apply directly through the PAG-IBIG Fund’s website or at one of their offices. The amount of funding you can receive will depend on several factors, including your monthly income, the cost of the improvements, and your ability to repay the loan.

Loan Programs Supporting Green Initiatives

As the push for sustainable housing gains momentum in the Philippines, various loan programs have emerged to support green initiatives. These programs are designed to assist homeowners interested in reducing their environmental footprint and transitioning towards a net-zero house.

Banks and other financial institutions in the Philippines have recognized the growing demand for eco-friendly living and responded with innovative green loan offerings. These loans are specifically tailored to fund projects that promote sustainability and energy efficiency. They cover a range of renovation works – from installing solar panels and energy-efficient appliances to comprehensive overhauls to achieve a net-zero house.

One notable example of a green financing initiative is the Bank of the Philippine Islands (BPI) collaboration with the International Finance Corporation (IFC). This partnership has led to the creation of the BPI-IFC Sustainable Energy Finance (SEF) program.

The SEF program is designed to provide financing options for projects focused on renewable energy, energy efficiency, and climate change mitigation. Although created for Small and Medium Enterprises (SMEs), this initiative makes it easier to undertake green renovations. It represents a significant step towards adopting sustainable practices in the Philippines.

Understanding the terms and conditions of green loans is crucial before starting your green renovation journey. Green loans often come with competitive interest rates and flexible repayment terms, reflecting the financial sector’s commitment to encouraging sustainable practices.

Securing a green loan involves a process similar to traditional loans. You’ll need to apply along with the necessary documents, which may include proof of income, credit history, and details of your proposed improvements. Some banks may also require a home assessment to verify the potential energy savings of your planned renovations.

One critical tip for securing a green loan is to have a clear, well-documented plan for your green renovation. This should include estimated costs, expected energy savings, and a timeline for completion. This information can make the application process smoother and increase your chances of approval.

Incentives for Renewable Energy Installation

Incentives are a powerful tool for encouraging the adoption of renewable energy installations, particularly in sustainable housing. In the Philippines, various incentives have been introduced to spur this transition towards sustainability.

One of the key incentives is the income tax holiday (ITH) offered to self-financed energy efficiency projects. This incentive can significantly lower the financial burden on homeowners and developers who invest in renewable energy facilities for their homes or property developments. It’s an attractive proposition that makes the idea of sustainable housing in the Philippines more financially viable.

Further tax incentives under the Renewable Energy Act 2008 have also been detailed under RR 7-2022. These incentives are designed to encourage taxpayers to invest in renewable energy. For example, those who install solar panels or other forms of renewable energy in their homes can enjoy income tax reductions and zero VAT advantages. These fiscal benefits make the shift to sustainable housing not only environmentally responsible but also economically rewarding.

The Board of Investments in the Philippines spearheads these initiatives by offering new incentives for companies investing in their renewable energy facilities. This move indicates a strong commitment from the government to promote sustainable practices in the corporate sector, which could also extend to the residential sector.

Beyond fiscal incentives, the country also offers non-fiscal incentives such as net metering, the first non-fiscal incentive program under the Renewable Energy Act. This allows homeowners and commercial establishments with solar power installations to sell excess electricity back to the grid. This not only offsets the cost of installation but also turns a home into a potential source of income.

Private and Non-Profit Financing Options

In the Philippines, the journey towards sustainable housing and affordable tiny homes is propelled by various private and non-profit financing options. With a growing focus on eco-friendly living, these financial resources are becoming increasingly vital.

Private financing plays a significant role in promoting sustainable housing projects. Banks such as BPI Family Savings Bank, Banco De Oro, and Land Bank of the Philippines offer various business loans, including franchising loans. These financial institutions often provide competitive interest rates and flexible repayment terms, making them an attractive option for investing in green housing projects.

For instance, BPI Family Savings Bank offers green financing solutions catering to the specific needs of those investing in sustainable housing projects. BPI has introduced Green Solutions, providing eco-friendly financing for housing and auto.

The program comprises Solar Mortgage, Eco-Build Financing, and EV Financing, aiming to offer sustainable choices with adaptable payment options. This dedication aligns with BPI’s overarching sustainability goals and reinforces its support for the UN SDGs.

Additionally, purely private sector loans do not require prior approval from the Bangko Sentral ng Pilipinas (BSP), which can simplify and expedite the loan application process. This ease of access to capital can be instrumental in driving the construction and development of sustainable housing and affordable tiny homes in the country.

On the non-profit side, several organizations offer grants that support sustainable development programs. Among the non-profit organizations making significant contributions to sustainable development and housing in the Philippines is Habitat for Humanity Philippines. Their mission goes beyond providing shelter; they endeavor to transform communities by advocating for systemic change toward sustainable living.

Another notable entity is the Philippine Green Building Initiative (PGBI), a group of professional leaders in the building industry committed to promoting greener building methods. PGBI offers certification programs such as GREEEN (Geared for Resiliency and Energy Efficiency for the Environment), which sets the country’s standard for sustainable construction practices.

These organizations, among others, play a pivotal role in driving the shift towards sustainable development, reflecting the broader global movement towards environmental responsibility and social equity.

Moreover, non-profit organizations (NPOs) can also play a significant role in funding sustainable housing projects. These entities can admit members, buy and sell real and personal property, and exercise other powers essential to their function. Funding for these organizations often comes from their revenues, public and private subsidies, donations, and other sources.

Utilizing Home Equity for Sustainable Renovations

As the movement towards sustainable housing and net-zero energy homes continues to gain momentum, homeowners are increasingly looking for ways to finance these green renovations. One such method is through the use of home equity.

Home equity refers to the difference between the market value of your home and the amount you still owe on your mortgage. As you pay off your mortgage, or if your home’s value increases, your equity grows. This equity can then be accessed through a home equity loan or line of credit (HELOC) to fund renovations to make your home more sustainable.

A home equity loan functions like a second mortgage, providing a lump sum of money you pay back over a set term. On the other hand, a HELOC works more like a credit card, giving you a revolving line of credit that you can draw from as needed.

Numerous banks in the Philippines provide home equity loans and HELOCs for homeowners seeking to fund their sustainable renovations. Security Bank is one such option, allowing you to leverage your home’s current value as collateral for the required funds. You can use this for various needs like education, buying equipment, travel, debt consolidation, or other uses. Additionally, it allows refinancing of housing loans from other banks if home equity exceeds 50% of the outstanding balance when applying.

Using home equity to finance green renovations has several advantages:

-

The interest rates are typically lower than those for personal loans or credit cards.

-

The repayment period is often longer, making the monthly payments more manageable.

-

The interest paid on home equity loans and HELOCs is often tax-deductible, which can lead to significant savings.

However, there are also risks associated with using home equity. The most significant risk is that your home is collateral for the loan. If you fail to make the payments, the lender could foreclose on your home. Therefore, it’s crucial to have a solid plan in place to repay the loan before you borrow against your home equity.

For homeowners considering leveraging their home equity for eco-friendly improvements, it’s essential to do so responsibly. Here are some best practices:

-

Have a Detailed Plan: Know exactly what renovations you want to undertake, how much they will cost, and how they will improve your home’s sustainability. This will help you avoid borrowing more than necessary.

-

Shop Around: Different lenders offer different interest rates and terms on home equity loans and HELOCs. Take the time to compare your options and choose the best fit for your needs.

-

Consider the Repayment Period: While a longer repayment period means lower monthly payments, it also means paying more in interest over the life of the loan. Consider your budget and financial goals when deciding on the length of your loan.

-

Stay Within Your Means: Borrow only what you can afford to pay back. Remember, your home is at risk if you cannot make the payments.

Building a Sustainable Future With a Helping Hand

The journey towards sustainable housing in the Philippines is more achievable with various financing options for green home renovations. Initiatives from private foundations, non-profit organizations, and government bodies provide a range of grants, loans, and incentives. Homeowners can also utilize their home equity responsibly to finance these eco-friendly improvements.

At BillionBricks, we support this vision of creating a world where no one is homeless and applaud the strides made in the Philippines. By leveraging these financial resources, homeowners can contribute to a more sustainable future with net-zero energy homes.

We build net-zero homes that are energy-efficient, self-sufficient, and affordable. Our net-zero homes and communities are coming to the Philippines this 2024. If you are interested in owning a net-zero home or developing a net-zero community, you may contact us here.

Learn more about sustainable living in the Philippines and dive into our other articles with valuable insights. Check out Eco-Smart Living: A Simple Guide to Sustainable and Connected Homes in the Philippines.

References:

-

2022 Revenue Regulations. (n.d.). REPUBLIC OF THE PHILIPPINES Bureau of Internal Revenue. Retrieved February 29, 2024, from https://www.bir.gov.ph/index.php/revenue-issuances/revenue-regulations/2022-revenue-regulations.html.

-

BPI pioneers green solutions for housing and auto loans. (n.d.). BPI. https://www.bpi.com.ph/about-bpi/news/bpi-pioneers-green-solutions-for-housing-and-auto-loans.

-

Briefing, A. (2023, September 15). Philippines Central Bank to introduce incentives for green financing. ASEAN Business News. https://www.aseanbriefing.com/news/philippines-central-bank-to-introduce-incentives-for-green-financing/.

-

Chandak, P. (2023, October 23). Philippines offers incentives for Self-Financed renewable energy projects. SolarQuarter. https://solarquarter.com/2023/10/23/philippines-offers-incentives-for-self-financed-renewable-energy-projects/.

-

Dehan, A. (n.d.). What is home equity and how can I access it? https://www.rocketmortgage.com/learn/home-equity#:~:text=Home%20equity%20is%20the,loan%20%E2%80%93%20and%20you%20build%20equity.

-

GREEEN | Philippine Green Building Initiative. (n.d.). PGBI. https://www.greenbuilding.ph/greeen.

-

Guide to FX transactions – Foreign loans, guarantees and other financing Schemes/Arrangements. (n.d.). https://www.bsp.gov.ph/Pages/Regulations/ForeignExchangeRegulations/PrivateSectorLoansBorrowings.aspx.

-

Home Equity Loan. (n.d.). Security Bank. Retrieved March 2, 2024, from https://www.securitybank.com/personal/loans/home-loan-housing-mortgage/home-equity-loan/.

-

Kow, J. L. (2023, November 28). All you need to know about PAG-IBIG solar financing. GetSolar. https://getsolar.ai/blog/pagibig-philippines-solar/.

-

Net Metering Home | Department of Energy Philippines. (n.d.). https://www.doe.gov.ph/net-metering-home.

-

PH gives more perks to firms using own renewable energy. (n.d.). Philippine News Agency. https://www.pna.gov.ph/articles/1212167.

-

Sustainability products and services | BPI. (n.d.). https://www.bpi.com.ph/about-bpi/sustainability/products-and-services#:~:text=The%20BPI%20SEF%20Program%20was,and%20Medium%20Enterprises%20(SMEs).

-

WHY WE BUILD :: Habitat for Humanity Philippines. (n.d.). https://www.habitat.org.ph/why-we-build.